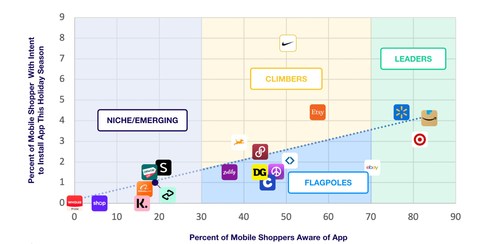

Etsy, Poshmark and Nike post scores on par with market leaders; eBay, Sam’s Club, and others face low intent challenges

Digital Turbine, Inc., Digital Turbine today released initial findings from its Q4 Shopping APP-ortunity Report. The report revealed that prior to the holiday shopping season 55% of mobile shoppers had already added at least one new shopping app, and analysis of future app intent revealed big opportunities and challenges facing 18 leading mobile shopping apps.

Digital Turbine, Inc., Digital Turbine today released initial findings from its Q4 Shopping APP-ortunity Report. The report revealed that prior to the holiday shopping season 55% of mobile shoppers had already added at least one new shopping app, and analysis of future app intent revealed big opportunities and challenges facing 18 leading mobile shopping apps.

Read More: SalesTechStar Interview With Jason Zintak, CEO At 6sense

While it was no surprise that the market was led by leaders Amazon, Walmart, and Target, the report identified Nike, Etsy, Poshmark, and Fetch Rewards as UA “Climbers”. The Climbers’ moderate level of awareness plus their relatively high overall “likeliness to install” sets up the possibility of even more solid UA (or user acquisition) gains. In contrast, eBay, Sam’s Club, and others had challenges of lower install intent despite high market awareness.

The first-of-its-kind report fills a void in mobile advertising insights by helping UA marketers use app awareness and app install intent to optimize their marketing strategies.

In addition to Climbers, the APP-ortunity report segments shopping apps into Leaders, Flagpoles, and Niche/Emerging Brands by analyzing app awareness and “likeliness to install”.

Read More:Post-Pandemic: After Gogoro, These Could Be The Next Taiwanese Startups On NASDAQ

The report also highlights how each segment can focus on different strategies to help fill their UA Growth funnels:

- Climbers: Characterized by solid awareness (between 30 and 70%) and above average install intent, these apps are in position to take advantage of a good growth opportunity. With interest up this season, Climbers are recommended to “Carpe Diem” and take a full funnel approach this holiday season by expanding budgets, adjusting daily caps, and increasing awareness through preloads and other on-device solutions, while continuing to focus on intent-based strategies.

- Leaders: Amazon, Walmart, and Target all rank ahead of the pack in brand awareness (above 70%). Combined with above average install intent and high install rates, user growth will have to come from finding more effective ways to get on the relatively few devices they’ve missed. New UA solutions like dynamic wizards integrated into the device O/S software update process can help. Leaders must also focus on driving use by their installed base, a significant portion of which are likely not active users.

- Flagpoles: The apps of these brands, like eBay, Craigslist and Sam’s Club, have solid awareness indicating they are well known. But unlike Climbers, their apps have a lower “likeliness to install” indicating that they may need to incent or find other ways to appeal to their market to maximize growth. Focusing on maximizing conversion rates through offers and seamless journeys from web to app, from services like Branch’s Journeys. They can also build their appeal through preloading on top brand devices.

- Niche/Emergers: With low awareness and low intent, many of the brands in this category either cater to smaller audiences, like Alibaba, which caters to the B2B market, or emerging, like AfterPay, whose tech focuses on deferred payment. For these companies, building awareness within their market is critical. These brands face conversion threats once a prospect gets to the App Store, where ads from other brands can be distracting. App Store Optimization is therefore critical, but SIngleTAP-enabled smart programmatic DSP strategies can also be used to lower distractions during the install process.

“While other reports focus on tallying installs that happen, we wanted to look at leading factors that drive install decisions – like awareness, intent, and favorability,” said Mike Ng, Chief Revenue Officer at Digital Turbine. “UA strategies are not homogenous, and depending on these factors, brands will want to try different things. The APP-ortunity framework creates a framework for our clients to be nimble and understand their marketplace opportunity. This is particularly critical as we enter a privacy-era where UA is becoming more difficult and optimal budget allocation is of utmost importance.”

The survey looked at consumer brand awareness and intent for many top shopping apps including:

| Afterpay | Amazon | Craigslist | Dollar General | eBay | Etsy |

| Fetch Rewards | Klarna | Nike | OfferUp | Poshmark | Sam’s Club |

| SHEIN | Shop | Target | Walmart | Wholee | Zulily |

The initial release focused on shopping apps, an app category found among the highest of interest this holiday season; however, the company said additional categories will be released in the coming months. Subsequent APPetite survey finds will be released on Entertainment, Audio/Music, Social, Travel, Health & Fitness, Food & Drink and Finance categories.

Methodology

Digital Turbine’s APP-ortunity research, an online survey of 1,000 U.S. mobile phone users, was completed in October/November of 2021. The survey asked questions about use of and interest in, apps within ten different categories. Sub-populations that showed interest in each category of apps were then asked more detailed questions about individual app awareness, as well as general, and specific app install intentions. Insights used in the Shopping APP-opportunity report were based on a subpopulation of 200 respondents interested in using their mobile devices for mobile shopping.