Thanksgiving shopping period set to be merry and bright for retailers despite supply chain and inflation challenges; digital trends continue to permeate even as shoppers return to stores

Key takeaways

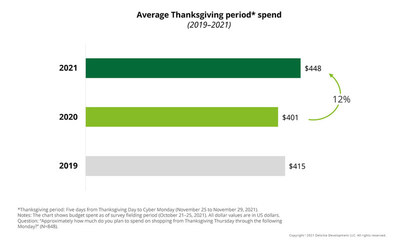

- Consumers will spend an average of $448, during the Thanksgiving period (Thursday, Nov. 25 – Monday, Nov. 29), up 12% from last year.

- Thirty-five percent of shoppers will spend more over the holidays than they originally planned.

- Supply chain challenges and inflation affecting many: 63% of holiday shoppers have already experienced stockouts, and consumers are being squeezed on price with 54% reporting higher prices, and 37% saying there are fewer discounts year-over-year.

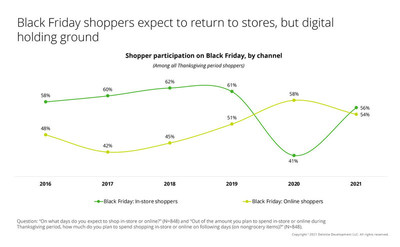

- Black Friday is regaining lost ground as 56% of consumers plan to shop in-store, up from 41% in 2020; the share of online sales for the day is holding steady at 18%.

Why this matters

Shoppers are busy making their lists and checking them twice, but stockouts and inflation are creating challenges for the season. As consumers continue to navigate a new normal as a result of the pandemic, Deloitte’s “2021 Pre-Thanksgiving Pulse Survey” examines what retailers can expect from shoppers during the period between Thanksgiving and Cyber Monday. Conducted online Oct. 21 – 25, the report surveyed 1,200 adults, ages 18 and over, who plan to shop during the holiday season.

Read More: U.S. Enterprises Turn To Contact Center-As-A-Service Providers To Meet New Consumer Expectations

Thanksgiving spending is set to shine, despite ongoing challenges

As pandemic anxieties diminish, consumers are reimagining Thanksgiving shopping traditions and navigating the new normal. Spending is expected to increase 12% to an average of $448, to surpass pre-pandemic levels. The surge is driven by middle-income shoppers who plan to spend an average of $504, up 18% from last year.

- More than one-third (35%) of holiday shoppers plan to increase their holiday spending compared to just two months ago; 41% of those planning to spend more will do so as a result of higher prices this year.

- Even though holiday shopper participation during the Thanksgiving period is on the decline, most (71%) still plan to shop this year, compared to 74% in 2020 and 79% in 2019.

- People are shopping earlier. Seven in 10 consumers (70%) said they started before the end of October (versus 66% last year and 61% in 2019) to avoid stockouts (70% versus 55% last year).

- Sixty-four percent of consumers will check to see if an item is in stock before they go to the store.

- Nearly two-thirds of shoppers (63%) have already experienced stockouts. When they do, six in 10 (60%) say they go look elsewhere. That suggests retailers will need to have a strong replacement strategy.

- Interest in gift items such as clothing (66%), toys (56%) and electronics (53%) remains steady. However, these categories are where shoppers have experienced the most stockouts. Additionally, shoppers buying food and beverage is up by 8 percentage points year-over-year to 52%.

- Of the shoppers who plan to increase their holiday spending compared to just two months ago, 55% will spend more on experiences and entertainment, up from 49% last year.

- Early holiday shoppers experienced discounts at similar levels (54%) or less often (37%) than last year; only 9% of early holiday shoppers saw higher promotions year-over-year.

- To stretch their budgets, 35% of consumers plan to use credit cards, and 30% will take advantage of buy now pay later options. These practices are even more prevalent among Millennials (46% and 48%, respectively).

Black Friday excitement returns

Black Friday and Cyber Monday continue to capture a significant share of the shopping budget during the Thanksgiving period. And while online shopping leads in traffic and average spend, in-store sales are likely to regain lost ground during the Thanksgiving period, as pandemic concerns continue to wane.

- Black Friday shoppers are expected to spend $135 on average in store, up from $124 in 2020.

- From Thanksgiving to Cyber Monday, online spending will comprise 60% of shoppers’ budgets, compared to 40% for in-store.

- Fifty-six percent of Black Friday shoppers (versus 41% last year) plan to shop in-store as safety concerns are waning. As a result, 18% of Thanksgiving budget will be spent in-store, up from 13% last year.

- The top reasons to shop in-store on Black Friday are to take advantage of the best deals (70%) and to experience the excitement of the day (35%). In addition, consumers expect to get an early start with 42% planning to shop between midnight and 6 a.m.

- As consumers continue to encounter higher prices, mass merchants (57%) and online retailers (54%) are the most preferred venues for shopping over the Thanksgiving period.

Read More: Take The PepsiCo Data Challenge And Produce Sales Forecasts 90% Faster

Key quote

“Thanksgiving has traditionally signaled the kick-off to the holiday shopping season. However, stockouts and inflation have caused consumers to start buying earlier to ensure they can get the best price for what they want, while it’s available. Retailers should be prepared to welcome shoppers throughout the holiday weekend as they prioritize items they can purchase and take home that day. In situations where supply chain and inventory are a challenge this season, retailers will need to have a strong substitution strategy in place to keep shoppers in the store or online.”

– Rod Sides, vice chair, Deloitte LLP, and U.S. retail, wholesale and distribution leader

The early bird gets the goods

Many consumers had planned to start their holiday shopping earlier this year to avoid stockouts. In fact, 70% of shoppers had already started by the last week of October.

- Half (51%) of consumers’ holiday budgets will be spent during the Thanksgiving period.

- However, consumers who started their holiday shopping before the end of October will spend more ($469) during the Thanksgiving period than those who start shopping in November or later ($394).

- Further, 87% of the early shopper’s budget is expected to be spent by the end of the Thanksgiving period.

Key quote

“As supply chain challenges continue to snowball, holiday shoppers have quickly realized that a turtle dove in the hand is worth two in the bush. While spending during the Thanksgiving period will be on the rise, overall participation will be down slightly. Many shoppers have already secured their wish-list items and taken advantage of retailers’ ‘rolling Black Friday’ offers. That said, early holiday shoppers are still set to spend more over Thanksgiving, demonstrating a merry opportunity for both in-store and online retailers.”

– Stephen Rogers, executive director, Deloitte Insights Consumer Industry Center, Deloitte LLP