Cars.com Inc., an audience-driven technology company empowering automotive, shared the top three dealer pain points in 2024 and how the company plans to help its customers solve these challenges to unleash growth. This news comes ahead of the 2024 NADA Show in Las Vegas Feb. 2-4, where dealers and partners can experience the Cars Commerce platform and its connected solutions live in booth #3421W.

“The challenges our industry faces in 2024 aren’t new. Consumers are digital-first, retailers are dealing with declining profitability and OEMs and dealers need to work together to solve for the seamless integration of online and in-store shopping experiences,” said Alex Vetter, CEO of Cars Commerce. “What is new is the technology we now have in place to solve these challenges. We built the Cars Commerce platform to solve the connected-commerce conundrum in automotive. Our platform unites the tiers and connects the shopper experience all while reducing complexity for retailers so they can sell more cars more profitably.”

According to a Cars Commerce dealer survey conducted in January 2024, the top three pain points automotive retailers are faced with this year are: Capturing higher-quality shoppers to drive market share, acquiring more used inventory and turning it for higher profit, and differentiating a dealership from its competitors.

Read More: GreyOrange Raises Item-Level Accuracy to 99% with gStore Overhead RFID Technology

(1) Capturing higher-quality shoppers to drive market share.

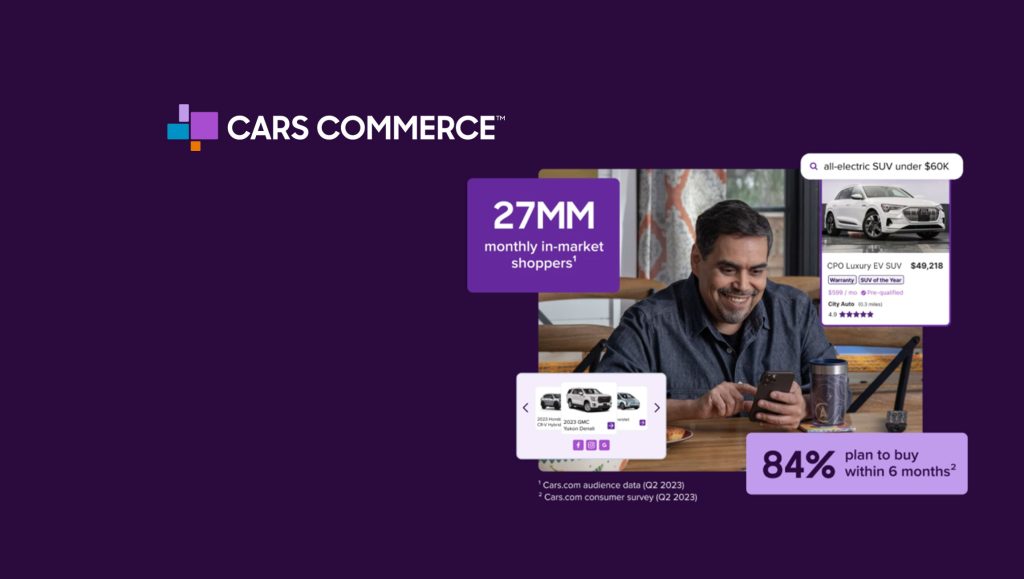

If there’s one thing a dealership – even a large multi-rooftop group – can’t do, it’s build a national distribution network of 26 million ready-to-buy car shoppers all in one place at the scale of a trusted marketplace like Cars.com¹. Cars.com has the highest percentage of organic traffic in its category – at over 60%² – and generates the most dealer website referrals per dealer compared to its closest competitors³. Not to mention, Cars.com hit a new all-time company record for total traffic in 2023, demonstrating continued growth in consumer demand for the No. 1 most-recognized automotive marketplace brand⁴.

To help its customers better leverage its unique audience and convert shoppers to buyers, Cars Commerce will debut at NADA VIN Performance Media, a new advertising solution that dynamically positions a retailer’s inventory in front of interested shoppers across search, social and display. The single-solution approach saves time and money while maximizing ad performance. In a recent pilot, VIN Performance Media delivered a 83% uptick in referral traffic to a dealer’s website and a 66% increase in referral conversions⁵.

According to Vetter, “The quickest way to reach local car shoppers and get a return on your advertising investment is to tap into the highly exclusive audience we’ve built, scrubbed and scrutinized over the last 25 years. This isn’t rocket science – you have to be positioned in front of the right people who are buying what you’re selling.”

(2) Acquiring more used inventory and turning it for higher profit.

New-car supply is up 45% year-over-year on Cars.com and steadily improving⁶. Supply has rebounded to levels similar to February 2021 and OEM incentives and rebates have materially increased from a year ago – for all intents and purposes, 2024 will be a “normal” year in terms of new-car inventory levels. As consumer demand begins to tick up for new cars, used inventory will be easier to access. The question for retailers is: How are you going to identify, find and procure the exact vehicles you need for your lot that will turn faster and for more profit?

AccuTrade, which can be demoed at NADA, offers instant, guaranteed cash offers for the 26 million in-market consumers on Cars.com – 56% of whom plan to trade-in a vehicle before they buy⁷ – and for the consumers visiting a dealer’s website. But the reach extends beyond that: AccuTrade’s Onboard Diagnostics (OBD) tool empowers everyone in the dealership to generate VIN-specific valuations from anywhere – in the showroom, on the lot, in the service drive or on the street – within minutes. Importantly, retailers can provide consumers with 100% confidence in any vehicle they appraise, and simply leverage the guaranteed offer backed by Cars Commerce for any vehicles they’ve procured that they don’t want to retail.

Through more than 1.9 million appraisals completed in 2023, retailers leveraged the AccuTrade technology to unlock new opportunities for acquisition growth. Half of the retailers leveraging AccuTrade in the service drive in 2023 at least doubled their volume of service drive appraisals from January to December.⁸

“The biggest mistake a retailer could make in 2024 is continuing to waste time, energy and money at outdated physical auctions to acquire used inventory. A healthy fleet is on the street – and AccuTrade can help you access it,” said Vetter.

(3) Differentiating a dealership from its competitors

According to Cars Commerce, winning the differentiation game in 2024 comes down to how well a retailer promotes his or her unique experience, and a dealership’s customers serve as the ultimate judge.

In an era where online reviews significantly influence consumer decisions on what and where to buy, the Cars.com Experience Report, available at NADA, is more than a measure of consumer satisfaction; it’s an analytical tool that delivers data-driven insights from the platform’s 13 million consumer reviews. The personalized report uncovers critical reputation-drivers for a dealership, dealership group or brand. The Experience Report includes metrics like review response rates and lead response quality, with a keen focus on financing, trade-in and price transparency from across review platforms on Cars.com, DealerRater, Google and Facebook.

“This year what will really separate the winners from the losers will come down to how efficiently retailers invest in and advertise their experience,” said Vetter. “As new-car inventory comes back, competition will heat up and most retailers will fall back on old habits — competing merely on price – but our industry needs to move beyond that and we have the solutions to make it happen.”

Retailers who meet today’s digital-first, convenience-focused generation where they are with messages about their “guaranteed instant cash offers right from the service drive,” their “speedy trade-in and sales process,” their “5-star reviews,” their “seamless online to offline experience” and their “digital instant financing tools to get pre-approved before coming into the dealership” will win the price war and far outpace the competition.