As US small business credit cards account for $430 billion in spending (or about 1 in every 6 dollars spent on general purpose cards), it’s important to understand which cards, costs, and features work best for your business.

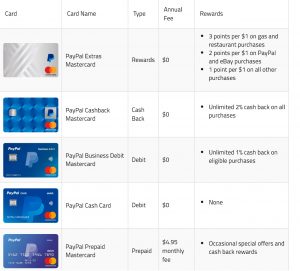

Like most financial institutions, PayPal offers a rewards card and cards with cashback rewards, as well as a simple debit card and a prepaid card. Each offering in the PayPal stable provides a unique option. Although only one card is aimed at businesses, owners can use any of their options for business purchases.

Read More: Why It’s Important To Take Control Of Your Data In Today’s Marketing

If rewards are attractive to you, PayPal offers the Extras Mastercard. This card is aimed at those who frequently shop at PayPal-accepting merchants and on eBay and offers bonus rewards for gas-station and restaurant purchases.

This credit card features three levels of rewards:

- 3 points per dollar spent at gas stations and restaurants

- 2 points per dollar spent on PayPal and eBay purchases

- 1 point per dollar spent on everything else

When you get your points, you get awards. Every 6,000 points, you can choose to redeem a $50 credit to your PayPal balance. You can also redeem points for airfare, hotel stays, car rentals, and vacation packages, which are attractive to hard-working small business owners who travel. As a bonus, this card carries no annual fees, although you will have to pay transaction fees when traveling abroad and the APR is higher than the industry standard.

PayPal Business Debit Mastercard: Debit Card For Instant Access To Business PayPal Account

PayPal also offers debit cards. The first of these is designed specifically to work with your Business PayPal account.

Unlike a credit card, you don’t need a credit check to receive the debit card. You also don’t need to worry about potentially paying an APR because the card simply draws from your available PayPal balance. However, you won’t be able to build up credit when using this card.

As an added bonus, PayPal gives an unlimited 1% cash back every month on eligible purchases. Purchases eligible for cash back include (but aren’t limited to) those processed as credit transactions. PIN-based transactions won’t qualify.

When buying outside of the US, you will be subject to a 1% foreign transaction fee. When compared to some credit cards, this fee is relatively low. However, businesses with frequent overseas travel may want to look into travel-specific credit cards.

You’ll also be able to withdraw cash via ATMs worldwide, with a standard $1.50 withdrawal charge. In partnership with Mastercard, there’s a zero-liability policy which will help you against fraud-related charges. On top of all this, there are no annual or monthly fees and you can request additional cards for your marketing team and other employees.

Read More: Using Personalization To Grow Sales

PayPal Cards Quick Comparison

If you don’t have a Business PayPal Account, PayPal offers a cash card for personal accounts.

Just like their business alternative, this is simply a debit card and is usable wherever Mastercard is accepted. You won’t need a credit pull while applying nor will you have to worry about paying interest. PayPal’s Cash Card does not feature any sort of reward scheme. That means this card is just for paying and withdrawing cash—you won’t be saving money using it.

It’s not possible for extra cards to be requested on the same account so employees to have their own PayPal accounts or go a different route entirely. Despite those negative points, you will have protection from fraudulent charges on this card thanks to PayPal and Mastercard’s zero liability program. There are no annual or monthly fees like you might get with some credit cards. There is, however, a 2.5% foreign transaction fee and a $2.50 withdrawal fee for ATMs outside the MoneyPass ATM network.

PayPal’s final offering comes in the form of their Prepaid Mastercard. This re-loadable card is accepted anywhere a Debit Mastercard would be accepted. That includes in-store purchases and orders over the phone or the Internet.

Read More: Account-Based Marketing (ABM) Is Your Growth Opportunity In 2019

You’ll be able to request a card without needing a credit check. Because it’s prepaid, you also don’t have to worry about any sort of interest, but there is a $4.95 plan fee due monthly.

To reload this card, you can use your PayPal balance. You can also top up at over 130,000 NetSpend Reload Network locations across the country. Additionally, there’s a direct deposit option that enables users to have paychecks, government benefits, and tax refunds directly deposited to a card’s account.

Beyond the card’s standard features, PayPal provides occasional rewards for using the Prepaid Mastercard. These rewards come in the form of money-saving offers based on your shopping history. You can also open an optional tiered-rate savings account through The Bancorp Bank and earn up to 5% Annual Percentage Yield (APY) for balances up to $1,000. As another reward bonus, the PayPal Prepaid Mastercard features a refer-a-friend program. This program will give you $5 for every friend you get to sign up for the card and load $10 onto it.

Owners seeking to leverage PayPal for business can find many attractive options, but like all credit and borrowing tools, it’s best to understand what works for your particular situation and research all options for the most attractive offer.

Read More: 3 Ways Productivity Affects Your Overall Business Success