Today’s consumer is bombarded with massive advertising campaigns by huge brands to persuade them to buy whatever it is they are trying to sell that day. Be it orange juice, carbonated beverages, pants, bacon, or baby formula – it’s buy this, buy that, put this on credit or a six month payment plan, and buy again out of the consumer’s always cash strapped wallet.

We all see this type of advertising bombardment as we go about our daily life, when you open an app, stream a show, drive past a billboard, turn on the radio and so on. For years consumers have been loyal to their brand of choice. They like brand X because that is what they have always purchased or it is what their friends and family recommend. That is all well and good for brands; however, these same consumers who have been purchasing the same product for years are now looking into rewards apps, bargains, and perceived value parity wherever they can in efforts to save a buck. Yes, wages have been increasing for just about everyone, which is great and should give consumers more purchasing power, but we are instead seeing consumers looking to cut expenses due to the toll increased inflation is having on the average American.

Growing awareness of reward apps and websites

Rewarded shopping apps and websites continue to gain traction due to their ability to allow greater flexibility, choice, and ultimately more savings. This rise in popularity led us to survey 53,868 of our users here at Influence Mobile, in efforts to better understand their brand preferences and awareness of rewards in the digital space. When asked, “Are you familiar with apps/websites where you can earn cash-back or points when you make purchases?” 79 percent said yes and only 21 percent said no.

Read More: Sopheon Redefines Innovation Management with the Launch of Acclaim Line of SaaS Offerings

Consumers are hungry to save

Consumers are growing tired of witnessing the products they purchased just a month go up in price while also shrinking in size. That’s why it was no surprise that when asked, “If you found a product that had a lower price and better value, would you try it out?” 98 percent said yes and only 2 percent said no. This response continued the sentiment that people are more open to trying new things if the product costs less and is perceived as a better value.

We also wanted to learn more about our players’ purchasing decisions, knowing that the value conscious are constantly looking for a bargain to save their cash for the products they are researching and purchasing. When asked, “What statement best describes your purchasing decisions”, 60 percent said they buy based on price, rather than brand name. 25 percent said they buy many brands, rather than the same one. 15 percent said they buy the same brands, rather than other brands. Not unexpected here to learn that if there are two similar products, the one that is priced lower will win when the value conscious consumer is shopping.

Read More: Amid Economic Uncertainty, Retailers Must Drive Personalized Experiences to Increase Conversions

Rewarded Shopping

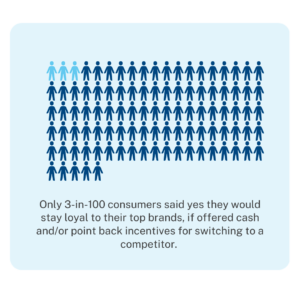

As for the demise of brand equity, if there is an incentive to try something new with cash back or points, the consumer is most likely going to give it a spin. Only 3-in-100 consumers said they would stay loyal to their top brands, if offered cash and/or point back incentives for switching to a competitor.

As for the demise of brand equity, if there is an incentive to try something new with cash back or points, the consumer is most likely going to give it a spin. Only 3-in-100 consumers said they would stay loyal to their top brands, if offered cash and/or point back incentives for switching to a competitor.

Conclusion

The survey concludes that the majority of consumers are willing to kiss brand equity goodbye if it means they are able to cut expenses. With the growing popularity of cash-back and reward earning apps, it’s time retail brands meet consumer demands, if not we learned that the consumer is going to look elsewhere for their products.